STC Pay is a digital financial platform that has transformed the way people conduct transactions in the Middle East.

As a part of the renowned Saudi Telecom Company, STC Pay was introduced to provide a seamless and secure method for everyday financial activities.

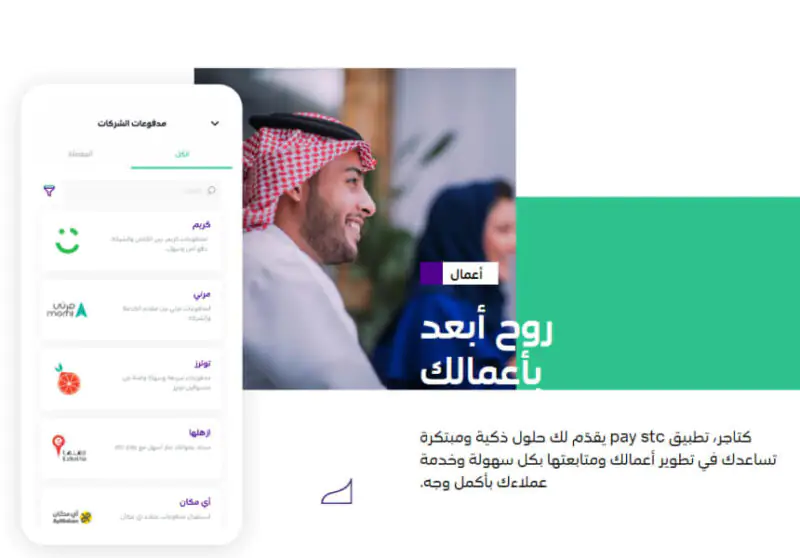

STC offers a variety of services, including STC Pay which provides online purchases, bill payments, and international remittances, all accessible through a user-friendly mobile app.

With its innovative approach, STC Pay is not just a payment service; it’s a lifestyle enabler that empowers users with the convenience and flexibility to manage their finances on the go.

Its growing popularity and user base are a testament to its reliability and the trust it has built within the community.

Buy STC Sawa Gift Cards are another type of STC service that can be used to purchase mobile services, the leading telecommunications company in Saudi Arabia.

Benefits of Using STC Pay

STC Pay offers a multitude of benefits that cater to the needs of its users, making financial transactions convenient, secure, and efficient.

Here are some of the key advantages of using STC Pay:

- International Remittance: Users can send money internationally and instantly through their mobile to over 525,000 Western Union locations worldwide, with competitive prices, instant refunds, and notifications of cash pick-up.

- Local Bank Transfers: Funds can be transferred to any local bank account in Saudi Arabia with ease, even during official holidays, for a nominal fee.

- Wallet-to-Wallet Transfers: Money can be transferred between STC Pay wallets quickly and securely.

- QR Code Payments: Payments for purchases at a wide range of shops, cafes, restaurants, and online stores can be made by simply scanning the merchant’s QR code.

- Bill Payments: Users can settle their STC bills directly through the app, which also allows for tracking of the bills.

- Mobile Recharge: Recharging SAWA prepaid lines is straightforward and can be done monthly without any hassle.

- Financial Management: The app provides money analytics to help users understand their spending behavior and encourages saving by comparing expenses with previous months.

- Marketplace Access: Users have access to a marketplace connecting them to products, services, and gaming experiences.

These features highlight STC Pay’s role as not just a payment service, but a comprehensive financial management tool that integrates into the daily life of its users.

How To Use STC Pay

Using STC Pay is a straightforward process that allows you to manage your finances with ease. Here’s a step-by-step guide on how to use it:

- Download the App: First, download the app from your smartphone’s app store.

- Create an Account: Open the app and sign up for an account by providing the required personal information.

- Add Money to Your Wallet: You can top up your wallet through various methods, including Apple Pay, bank transfer, SADAD, or by adding a credit/debit card.

- Make Payments: To make a payment, select the ‘Pay’ option and scan the merchant’s QR code or enter their STC Pay number.

- Transfer Funds: For wallet-to-wallet transfers, choose the ‘Transfer’ option and enter the recipient’s wallet number. For bank transfers, select the bank and enter the account details.

- International Remittance: To send money internationally, go to the ‘International Remittance’ section and follow the prompts to send funds to over 525,000 Western Union locations worldwide.

- Bill Payments and Mobile Recharge: You can pay your bills and recharge your mobile directly through the app.

- Create a Digital Visa Card: If you want to create an STC Pay digital Visa card, go to the ‘Cards’ tab, select ‘Digital Card’, and follow the instructions to choose a design and pay the annual fee.

- Withdraw Cash: You can withdraw cash from your STC Pay wallet at compatible ATMs.

What Are The Banks That Deal With STC Pay?

It has partnered with several banks to facilitate easy and instant local transfers within Saudi Arabia.

As of the latest available information, the partner banks include:

- Riyad Bank

- Alinma Bank (ANB)

- Samba Financial Group

- Banque Saudi Fransi

- Alawwal Bank

- Saudi British Bank (SABB)

These partnerships ensure that users can enjoy seamless transactions with these financial institutions, making it convenient to manage their finances and perform various banking operations.

Conclusion

STC Pay stands out as a beacon of financial technology innovation, offering a comprehensive suite of services that cater to the modern user’s need for convenience, security, and efficiency.

From facilitating local and international transfers to enabling easy bill payments and mobile recharges STC Pay has proven to be a reliable and indispensable tool in the digital age.

Its partnerships with major banks and integration with global systems like Western Union underscore its commitment to providing seamless financial experiences.

As it continues to evolve and expand its services, STC Pay is set to remain at the forefront of the fintech revolution, empowering users to manage their finances with confidence and ease.

FAQs:

Is it possible to transfer internationally via STC Pay?

Yes, you can transfer money internationally through STC Pay. It offers secure and smooth transfers with competitive prices, instant refunds upon cancellation, and hidden fees.

You can send money to more than 525,000 Western Union locations worldwide or international bank accounts in over 100 countries.

Is it possible to transfer money from Egypt to Saudi Arabia?

Yes, you can transfer money from Egypt to Saudi Arabia via STC Pay, it does facilitate international transfers to a wide range of countries, including Egypt, with a fee of 15 SAR.

How do I withdraw my money from STC Pay?

To withdraw money from your wallet, you can use an ATM that supports STC Pay withdrawals.

The process typically involves selecting the ‘ATM Cash Withdrawal’ option in the app, finding a nearby ATM, and then scanning the QR code on the ATM screen to confirm the transaction and receive the cash.

Aya Atef

I'm Aya, a content creator at ARPay, crafting engaging articles about payment gift cards, digital installments, and everything that makes online shopping seamless. Whether it's gaming top-ups or the latest e-commerce trends, I write to level up your shopping experience!