Prepaid cards are a convenient and secure way to pay for goods and services online and offline.

They are similar to debit cards, but they are not linked to a bank account.

Instead, they have a fixed amount of money loaded on them, which you can spend as you wish.

Prepaid cards are also known as gift cards, e-cards, or vouchers.

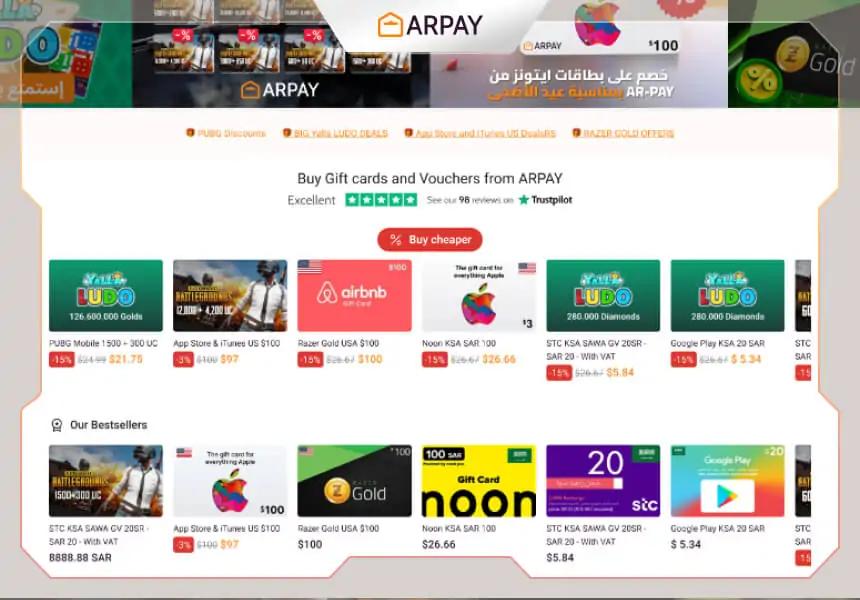

ARPay is an e-commerce platform that sells prepaid cards for various brands, such as supermarkets, games, and applications.

You can buy prepaid cards from ARPay using different payment methods, such as debit or credit cards, or PayPal.

You can also redeem your prepaid cards directly on the merchant’s website or app.

In this article, we will tell you 10 things you need to know about prepaid cards and ARPay.

Whether you are a buyer or a seller, you will find some useful tips and insights on how to make the most of prepaid cards.

Who is ARPay?

ARPay is a Emirati company that was founded in 2014 by HKS Group who wanted to create a simple and convenient way to buy and sell prepaid cards online.

ARPay’s mission is to provide a platform that connects buyers and sellers of prepaid cards, and offers them a variety of benefits, such as:

- A wide selection of prepaid cards for different categories, such as supermarkets, games, and applications.

- Competitive prices and discounts on prepaid cards.

- Multiple payment options, including debit and credit cards, and PayPal.

- Fast and secure delivery of prepaid cards via email.

- Easy and flexible redemption guides of prepaid cards on ARPay blog website to do on the merchant’s website or app.

- Customer support and loyalty program.

ARPay is a trusted and reputable platform that has thousands of satisfied customers and partners.

ARPay is also compliant with the relevant laws and regulations regarding e-commerce and data protection.

What are the Prepaid cards?

Prepaid cards are plastic or digital cards that have a fixed amount of money loaded on them.

They are similar to debit cards, but they are not linked to a bank account.

You can use prepaid cards to pay for goods and services online and offline, as long as the merchant accepts them.

Prepaid cards are also known as gift cards, e-cards, or vouchers.

They are usually issued by specific brands, such as supermarkets, games, and applications.

For example, you can buy a prepaid card for Amazon, Netflix, Spotify, or Steam.

You can also buy a prepaid card for a generic category, such as food, entertainment, or travel.

Prepaid cards have several advantages over other payment methods, such as:

- They are easy to use. You just need to enter the card number and the PIN or scan the QR code to make a payment.

- They are secure. You don’t need to share your personal or financial information with the merchant or the platform. You also don’t need to worry about losing your card or having it stolen, as you can easily block it or replace it.

- They are convenient. You can buy prepaid cards online or offline, and receive them instantly via email or SMS. You can also use them anytime and anywhere, as long as you have internet access.

- They are flexible. You can choose the amount and the currency of your prepaid card. You can also use it partially or fully, depending on your needs and preferences.

- They are fun. You can use prepaid cards to treat yourself or to surprise someone else. You can also personalize your prepaid card with a message or a design.

How to use Prepaid cards

Using prepaid cards is very simple and straightforward. Here are the steps you need to follow:

- Buy a prepaid card from ARPay. You can choose the brand, the amount, and the currency of your prepaid card.

- Receive your prepaid card via email. You will get a card number and a PIN or a QR code that you can use to make a payment.

- Redeem your prepaid card by reading the redemption guide on ARPay which will show you what to do on the merchant’s website or app. You can either use the whole amount of your prepaid card or a part of it. You can also check the balance and the expiry date of your prepaid card on the merchant’s website or app.

- Enjoy your purchase. You can use your prepaid card to buy goods and services from the merchant that issued it. For example, you can use an Amazon prepaid card to buy books, electronics, or clothing from Amazon.

10 Things you need to know about Prepaid cards

Prepaid cards are a great way to pay for goods and services online and offline.

However, there are some things you need to know about them before you buy or use them. Here are 10 things you need to know about prepaid cards:

- Prepaid cards have an expiry date. Most prepaid cards are valid for a certain period of time, usually between 6 months and 2 years. You need to use your prepaid card before it expires, otherwise you will lose the money on it.

- Prepaid cards have fees and charges. Some prepaid cards may have fees and charges associated with them, such as activation fees, transaction fees, or maintenance fees. You need to check the terms and conditions of your prepaid card before you buy or use it, and avoid any hidden costs.

- Prepaid cards have limits and restrictions. Some prepaid cards may have limits and restrictions on how much you can spend, where you can use them, or what you can buy with them. You need to check the details of your prepaid card before you buy or use it, and follow the rules and regulations.

- Prepaid cards are not refundable or exchangeable. Once you buy a prepaid card, you cannot return it or exchange it for another one. You also cannot get a refund or a cashback for your prepaid card, unless there is a problem with it or with the merchant.

- Prepaid cards are not protected or insured. Unlike credit cards or debit cards, prepaid cards are not protected or insured by any authority or institution. If you lose your prepaid card or have it stolen, you may not be able to recover your money or get a replacement. You also may not be able to dispute or reverse a transaction made with your prepaid card, unless there is fraud or a mistake.

- Prepaid cards are not linked to your identity or credit history. Prepaid cards are anonymous and do not require any personal or financial information from you. This means that you can use them without revealing your identity or affecting your credit score. However, this also means that you cannot use them to verify your identity or to build your credit history.

- Prepaid cards are not accepted everywhere. Prepaid cards are only accepted by the merchants that issued them or by the platforms that support them. You cannot use them to pay for goods and services from other merchants or platforms. You also cannot use them to withdraw cash from ATMs or to make international payments.

- Prepaid cards are not the same as gift cards or e-cards. Prepaid cards are different from gift cards or e-cards, even though they may look similar or have similar names. Gift cards or e-cards are usually issued by a specific merchant or platform, and can only be used to buy goods and services from them. Prepaid cards are issued by a generic category, and can be used to buy goods and services from different merchants or platforms within that category.

- Prepaid cards are not the same as debit cards or credit cards. Prepaid cards are different from debit cards or credit cards, even though they may function similarly or have similar features. Debit cards or credit cards are linked to a bank account or a credit line, and allow you to access your money or borrow money from a bank or a provider. Prepaid cards are not linked to any account or line, and only allow you to spend the money that you have loaded on them.

- Prepaid cards are not the only option. Prepaid cards are one of the many options that you have to pay for goods and services online and offline. You can also use other payment methods, such as cash, credit cards, debit cards, PayPal, cryptocurrencies, or bank transfers. You need to compare the pros and cons of each option, and choose the one that suits your needs and preferences.

How to buy Prepaid cards From ARPay

Buying prepaid cards from ARPay is easy and convenient. Here are the steps you need to follow:

- Visit the ARPay website. You can access ARPay from any device, such as a computer, a tablet, or a smartphone.

- Browse the categories and brands of prepaid cards. You can choose from a wide selection of prepaid cards for different categories, such as supermarkets, games, and applications. You can also search for a specific brand or a keyword.

- Select the prepaid card that you want to buy. You can choose the amount and the currency of your prepaid card.

- Choose the payment method that you want to use. You can pay for your prepaid card using different payment methods, such as debit or credit cards, or PayPal.

- Confirm your order and complete the payment. You will receive a confirmation email with the details of your order and the payment. You will also receive your prepaid card via email within minutes.

- Enjoy your prepaid card. You can redeem your prepaid card with the redemption guides on ARPay.

How to redeem Prepaid cards

Redeeming prepaid cards is also easy and convenient. ARPay has lots and lots of redemption guides for every merchant. Here are the steps you need to follow for each option:

- Redeem your prepaid card on the merchant’s website or app. Here are the steps you need to follow:

- Visit the merchant’s website or app or download it from the App Store or the Google Play Store.

- Browse the goods and services that you want to buy and add them to your cart or your wishlist.

- Go to the checkout page or click on the Pay button.

- Choose the prepaid card option as your payment method or enter the card number and the PIN or scan the QR code of your prepaid card.

- Confirm the payment and check your receipt. You will see the amount of your prepaid card deducted from your total amount. You will also receive a confirmation email or SMS with the details of your order and the payment.

- Enjoy your purchase. You will receive your goods and services from the merchant according to their delivery policy and terms and conditions.

Conclusion

Prepaid cards are a convenient and secure way to pay for goods and services online and offline.

They are easy to use, flexible, and fun.

You can buy prepaid cards from ARPay, a trusted and reputable platform that offers a wide selection of prepaid cards for different categories, such as supermarkets, games, and applications.

You can also redeem your prepaid cards on the merchant’s website or app.

We hope you enjoyed this article and learned something new about prepaid cards and ARPay.

If you have any questions or feedback, please feel free to contact us or leave a comment below. We would love to hear from you.

Thank you for reading and happy shopping!

FAQs

What is ARPay?

ARPay is an e-commerce platform that sells prepaid cards for various brands, such as supermarkets, games, and applications.

What are prepaid cards?

- Prepaid cards are plastic or digital cards that have a fixed amount of money loaded on them.

- You can use them to pay for goods and services online and offline, as long as the merchant accepts them.

How can I buy prepaid cards from ARPay?

- You can buy prepaid cards from ARPay using different payment methods, such as credit cards, debit cards, or PayPal.

- You can also choose the amount and the currency of your prepaid card.

How can I redeem prepaid cards?

You can redeem prepaid cards on the merchant’s website or app with ARPay redemption guides.

What are the benefits of using prepaid cards?

- Prepaid cards are easy to use, secure, convenient, flexible, and fun.

- You can use them to treat yourself or to surprise someone else.

- You can also avoid fees, charges, limits, restrictions, and identity or credit issues.